Last updated on October 8, 2024

To help ensure accuracy, this page was written, edited and is periodically reviewed by a knowledgeable team of legal writers per our editorial guidelines. It was approved for publication by founding attorney Samuel Siemon, who has amassed extensive experience as a Georgia family law attorney. Our last modified date shows when the page underwent a review.

Georgia Property Division Lawyers

Separating the financial lives of two people in a divorce can be a complex process. Next to child custody, marital property division is one of the most contentious issues in divorce. Once you agree to a settlement, you are bound to it. Absent issues such as fraud, there are no do-overs when it comes to the division of marital property.

At The Siemon Law Firm Divorce and Family Law Attorneys, P.C., we are highly experienced in marital property division. Our goal is to protect your financial interests during every step of the divorce process. We engage forensic accountants and professional evaluators when necessary to identify and value all marital assets in which you have an interest.

If you have questions about asset division, property division or other related practice areas, you can count on our family law firm. Contact us online or call 770-888-5120 to talk with one of our experienced and compassionate family law attorneys in the greater Atlanta area.

How Are Marital Assets Divided In Georgia?

Except for a few types of assets, such as inheritances and personal gifts, most assets and debts acquired during the marriage are considered the joint property of both spouses. Those assets and debts may include retirement plans, including 401(k)s and teacher retirement plans, bank accounts, stocks, vacation property, vehicles, credit card debt, and other assets and liabilities.

Dividing marital assets and debts can pose a significant challenge, especially when the stakes are high. Georgia courts follow the rule of equitable property division, which means that marital assets must be divided fairly — though not necessarily 50-50 — between the parties. To decide what is fair, the court will consider several factors, including:

- The age, health, education and overall earning potential of each party

- The financial needs of both parties

- The conduct of each spouse throughout the marriage

- The length of the marriage

- Any separate assets or nonmarital property

- Any prenuptial, postnuptial or separation agreements

Our divorce lawyers will work to protect you from any adverse effects of having cosigned your name to loans for which your spouse is solely responsible. For instance, if both your names are on a credit card that only your spouse uses, we can help ensure that creditors cannot come after you for that debt.

What Will Happen To The House?

For many divorcing couples, issues surrounding the family home are numerous and complex. Many cannot agree upon who will remain in the home. Others have differing positions on the value of the homestead. And some simply do not know how to proceed in property division when they owe more than their house is worth.

Our divorce lawyers understand your family home can hold significant financial and emotional value. As your counsel, we will listen carefully to understand your primary goals regarding your home, before carefully providing the best options for achieving your homestead objectives.

There are several possible resolutions when a marital residence must be divided:

- The house can be sold and the equity (or debt, if the mortgage was underwater) can be divided.

- If one party was the cause of the breakup of a marriage, the judge may decide that it isn’t fair to ask the innocent spouse to lose the marital residence.

- If you have minor children, the judge may decide that it would be in the best interests of your children to continue to live in the marital residence with the parent who has primary physical custody. In this case, the judge may set a future date at which time the house would be sold and the equity divided.

- You and your spouse could exchange assets of equal value: for example, giving up your right to a percentage of your spouse’s 401(k) or other retirement plan funds in exchange for the marital residence.

- Less common resolutions include both spouses moving out and renting the homestead to a third party, or having the children remain in the home while the parents rotate in and out according to a parenting schedule.

If you and your spouse exchange assets, it’s important to recognize that equity in a home is not worth as much as cash, especially in today’s real estate market. There is no guarantee that your house will sell for a certain amount, and it may remain on the market for a long time. When exchanging assets, you also need to consider the tax consequences. IRA and 401(k) accounts are taxable upon withdrawal of funds, while a one-time capital gain on a house may not be taxable.

Common Questions About Divorce And Keeping The House

Family law issues involving your home during divorce can become much more complex than deciding who will stay and who will move. However, our family law lawyers are equipped to address any additional difficulties regarding your home. Do any of the following questions apply to you:

- Can I stay in my home while the divorce is in progress?

- What if only one of us is listed on the home title?

- What if my spouse and I have different value estimates of our home?

- I want to stay in my home but I’m not sure I can afford it. What are my options?

- What can I do if my spouse will not vacate our home after a court order?

- My spouse is preventing the sale of our home per our divorce agreement. What can I do?

Regardless of the homestead issues and other related legal matters you face, there are always solutions. The key is to work with experienced legal professionals, such as our attorneys, in order to find effective resolutions.

Division Of An IRA In A Georgia Divorce

An individual retirement account or arrangement (IRA) is a very important facet of many people’s plans for the future. Without adequate retirement savings, the latter years of life may be an intense struggle to make ends meet instead of a peaceful conclusion to a long career.

We have years of experience in complex asset division cases. We are mindful of the needs of each spouse, and work to resolve each case in a timely and cost-effective way. Our experienced team of family law lawyers assists divorcing clients with the equitable division of retirement accounts, including:

- Traditional IRAs involving tax-deductible contributions

- Roth IRAs involving post-tax contributions

- SEP IRAs that allow employers to contribute to employees’ traditional IRAs

- Savings Incentive Match Plan for Employees (SIMPLE) IRAs that require employers to match employee contributions

- Self-directed IRAs that allow individuals to make retirement investments

In divorce, an IRA can often be divided without using a qualified domestic relations order (QDRO). Sometimes, however, a QDRO is required. It will depend on the plan administrator.

Dividing Businesses And Practices In Georgia Divorce

Equitable distribution laws are complex. Even if you owned the practice before your marriage, a portion of the practice may be considered marital property if:

- The practice increased in value during your marriage

- Your spouse contributed to the practice, either by working for the practice or by contributing in other ways (such as performing household duties that allowed you to concentrate on the practice)

- You contributed marital property assets to the practice

- You included your spouse’s name in the practice

Our divorce attorneys have extensive experience protecting the interests of clients with complex assets such as businesses and practices.

Am I Responsible For My Spouse’s Credit Card Bills?

Many people who go through the divorce process are blindsided by their spouse’s credit card bills. In Georgia, both assets and debts accumulated during the marriage are considered marital property and must be divided as a part of your divorce orders according to the law of equitable distribution. Equitable usually means 50-50, but a judge could determine that an unequal distribution is equitable. One way you can protect yourself from additional debt is to cancel joint credit cards as quickly as possible.

Even if the credit card was opened under your spouse’s name alone, it is still marital debt if it was acquired during the marriage. Both parties may be responsible. However, if your spouse runs up excessive credit card debt for expenses that are clearly personal (such as taking a boyfriend or girlfriend to Las Vegas), the judge in Atlanta may assign those debts to your spouse in the divorce order. The credit card company may still hold you responsible for the debt if it is a joint account, and it could affect your credit rating.

How Can I Keep My Spouse From Running Up Credit Card Debt?

If a divorce is in your future, you should cancel joint credit card accounts and open new ones in your name alone. You will still be jointly responsible for existing debts on the canceled cards. It’s not unusual for a couple to have more debts than assets at the time of divorce.

Forensic Accounting: Following The Money Trail

Hiring an expert forensic accountant can be an important step in some divorces. If you and your spouse own a business together, if you have a trust account or if your marital finances are particularly complicated, forensic accounting may be needed. It can also be required if you believe your spouse may be deceiving you about where the money went or where your assets are.

Our attorneys work with top-flight forensic accountants to uncover the true financial picture for our clients. Such detailed analyses are not necessary for every divorce. For complex divorces or ones involving active deception or hidden assets, however, we can use this tool to determine the actual income of a family business, track down overseas bank accounts and generally “follow the money trail.”

To Schedule A Consultation In The Metro Atlanta Area

Property division cannot be modified after your divorce is final, so it is vital to have qualified legal representation now. Call The Siemon Law Firm Divorce and Family Law Attorneys, P.C. at 770-888-5120 or fill out our contact form to learn how our attorneys can protect your property rights.

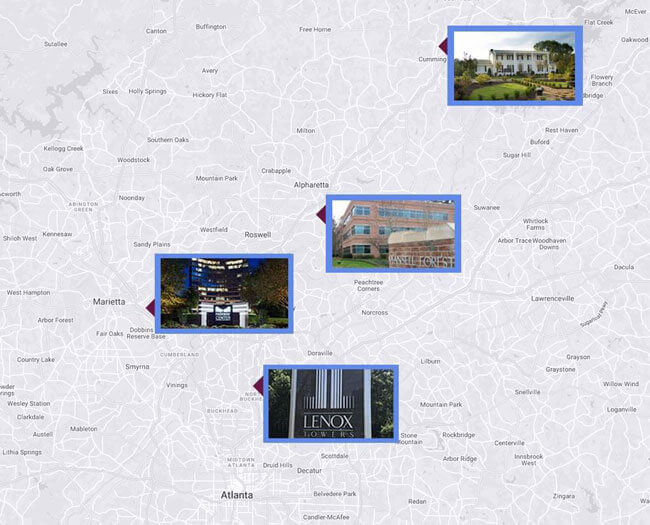

We can also assist with other related family law matters, including alimony or spousal support, child support, child custody, postnuptial agreements and other legal issues that can arise in divorce cases. We have four law office locations for your convenience, located in Alpharetta, Atlanta, Cumming and Marietta.

Client Review: 5/5 ★ ★ ★ ★ ★

“If you are going through a situation that has caused you to make it to this review, I’m so sorry. It sucks. But do yourself a favor and heed my advice. You will be so happy you did. Unfortunately, I had to seek out a law firm to handle a divorce for me. This has been an extremely difficult time in my life, that I would not wish on anyone. I had a lot to protect going into this. Doug and everyone else have helped me so much. All that was important to me, in choosing this firm, was that I keep my money and assets. That happened, but I was also treated with so much respect and compassion. These guys specialize in this, and only this. This is what they do. I cannot recommend them enough.”

Kyle H.