Last updated on March 3, 2022

Saving future retirement during divorce

On behalf of Douglas Hassinger

Retirement assets can be at risk of high taxation and fees when split during divorce if the right processes are not used.

Couples in Atlanta who are considering a divorce or even perhaps in the midst of a divorce find many of their assets under siege. This involves hard-earned retirement savings as more and more people must split their retirement accounts in divorce settlements.

As noted on the Georgia Statutes website, Georgia is an equitable distribution state. This means that any divorce property division settlement must result in a fair and equitable distribution between husbands and wives but not necessarily a completely even one. Retirement assets such as pension funds, 401k or 403b accounts and Individual Retirement Accounts are all examples of items to be split in this way.

How should divisions be noted?

When splitting retirement accounts in a divorce , the appropriate legal processing must take place. What exactly this is differs based upon the type of account being divided. According to Investopedia, any division of a traditional or Roth Individual Retirement Account should only be done with a corresponding transfer incident to divorce. Similarly, any division of a 403b fund or 401k fund should only be done with a corresponding Qualified Domestic Relations Order or a QDRO.

The transfer incident to divorce and QDRO legally protect account holders and spouses who receive funds from accounts from paying early withdrawal fees or taxes. These payments can be required if tax entities view the transfer of funds as simply a distribution from an account before retirement. When a transfer incident to divorce or QDRO is used, the transfer is clearly attributed to a divorce settlement and therefore the taxes and fees are avoided.

Bankrate points out that some of the early withdrawal fees can amount to a total of 10 percent of the value of an account. For an account worth $250,000 that could mean an immediate loss of $25,000. A loss of $100,000 could result when a fund’s value is at the $1,000,000 level.

The fine details matter

In addition to proper processing, how settlements identify splits is critical. This is because there is a delay between the date at which an agreement is reached and the date that a transfer is completed. If an account is worth $500,000 and is to be split equally, the decree should state that each spouse shall receive 50 percent of the value. That way, if the fund increases or decreases in value before the date of the transfer, the original intent is maintained.

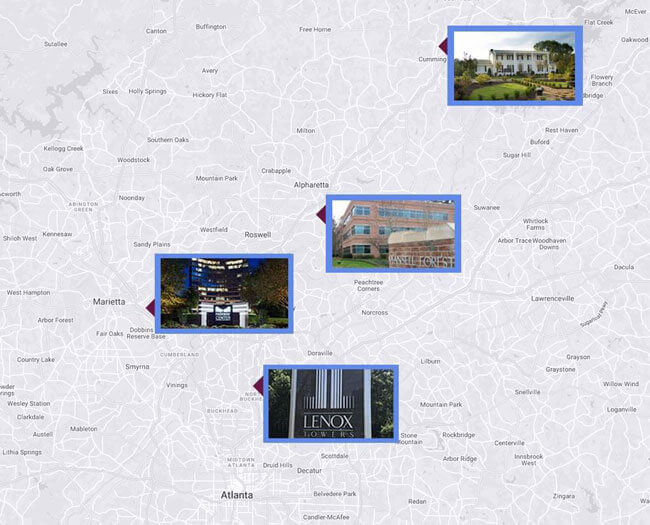

It is nuances like these that make it imperative for people in Atlanta to work with experienced attorneys when getting divorced.