Last updated on April 16, 2021

To help ensure accuracy, this page was written, edited and is periodically reviewed by a knowledgeable team of legal writers per our editorial guidelines. It was approved for publication by founding attorney Samuel Siemon, who has amassed extensive experience as a Georgia family law attorney. Our last modified date shows when the page underwent a review.

Effectively Divide Retirement Accounts With A Qualified Domestic Relations Order

If you are divorced in Georgia, your marital property will be divided according to the law of equitable distribution. Those assets will include the portion of any pension plan, 401(k) account, IRA account and other retirement plan assets that were accumulated during the marriage. Even though assets may not be payable at the time of your divorce, they are divided during the divorce using a special court document known as a qualified domestic relations order (QDRO).

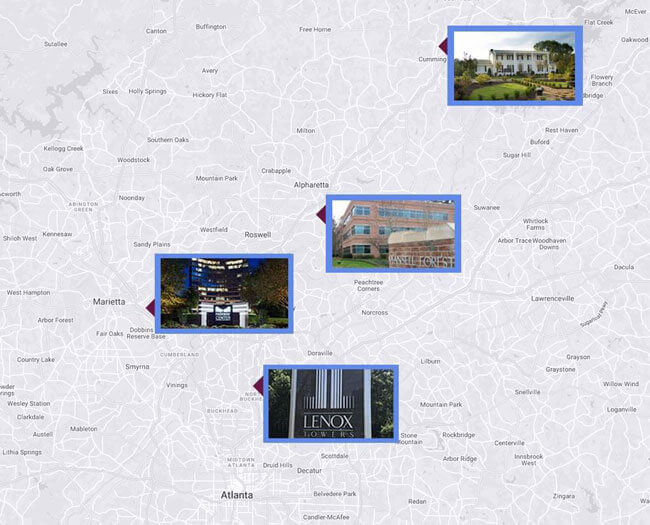

At The Siemon Law Firm Divorce and Family Law Attorneys, P.C., our lawyers are here to protect your financial interests if you are going through a divorce. With four convenient office locations, we draft qualified domestic relations orders for men and women throughout the Atlanta metropolitan area.

What Is a Qualified Domestic Relations Order?

A QDRO is a domestic relations order that recognizes the right of another person (known as an alternate payee) to receive some or all of a participant’s retirement plan. A court may issue a qualified domestic relations order as part of a divorce or a probate proceeding after the plan participant’s death. The order is provided to the plan administrator.

The order must meet specific legal requirements and provide the following information to the plan administrator:

- The name and mailing address of the plan participant and the alternate payee

- The name of the retirement plan or plans the order applies to

- The percentage of the benefit or the dollar amount to be paid to the alternate payee

- When and how payments will be made

A 10 percent early withdrawal penalty may apply if assets are withdrawn from a 401(k) or IRA before you reach age 59.5 years old. You can avoid the early withdrawal penalty by rolling the withdrawal over into a qualified retirement plan account.

Retirement plan assets must be divided at the time of divorce. You cannot go back to court after your divorce and divide marital property except in cases of fraud.

Contact Our Attorneys Today

If you have questions about obtaining some or all of your spouse’s retirement assets, our lawyers are here to advise you. Please contact us today in Alpharetta, Atlanta, Cumming or Marietta and arrange a personal, discreet consultation.